AI AGENTS FOR banking

Speed Up Every Transaction and Decision With AI Agents for Banking

Your best prospects shouldn't slip away because someone forgot to follow up. DRUID AI agents nurture every lead with personalized follow-ups and gather the intel your sales team needs to make their calls count.

Global clinics and hospitals trust DRUID AI Agents

0%

of customer relationships in banking will be managed without interacting with humans

0%

of customer interactions will be automated using AI Agents and intelligent apps

0B

customer service hours will be saved using AI Agents powered by Generative AI

10x Faster Customer Onboarding

Forget lengthy application processes. DRUID's AI agents handle KYC procedures, document verification, and account setup automatically, turning what used to take weeks into a simple conversation that gets completed in minutes.

- Customer onboarding that completes fast with full KYC capabilities

- Register, authenticate, and open accounts quickly and easily

- Onboard customers 10x faster through automated processes

.png?width=628&height=628&name=Visual%20Container%20(2).png)

.png?width=628&height=628&name=Container%20(1).png)

Faster Processing for Loan and Mortgage Applications

End the paperwork nightmare. DRUID's AI agents guide customers through applications, automatically verify documents, and process approvals faster, creating a smooth experience that actually gets deals closed.

- Loan and mortgage applications that process faster

- Automate document verification and approval workflows

- Optimize leasing offer generation and contract signing processes

Turn Compliance Into Competitive Advantage

Stop scrambling to meet compliance deadlines and manually generating reports. DRUID's AI agents automatically handle regulatory requirements, generate accurate compliance reports, and ensure your bank stays audit-ready without the constant stress.

- Regulatory compliance and reporting handled automatically

- Internal support that empowers staff with compliance expertise

- Ensure audit-readiness without manual oversight stress

.png?width=628&height=628&name=Visual%20Container%20(3).png)

HEALTHCARE | CUSTOMER SUPPORT

MatrixCare is Enhancing Customer Support Responsiveness with DRUID AI Agents for Healthcare

MatrixCare enhances healthcare support efficiency with DRUID’s agentic AI solutions, delivering prompt, accurate answers and setting new standards in response quality.

+0%

integrated AI Knowledge base articles for instant replies

+0%

accuracy for answers delivered by AI agents

24/7

availability improving service consistency and speed

KEY CAPABILITIES

Transform complexity into insights

Your team's drowning in disconnected tools while AI promises stay just that - promises. DRUID's Conductor orchestrates agentic AI across your entire tech stack, so your people work more efficiently from one interface.

AI Agent Orchestration

Enables creation and orchestration of AI agents that integrate processes, data, and systems to automate workflows.

Enables creation and orchestration of AI agents that integrate processes, data, and systems to automate workflows.

Enterprise Knowledge

Enables creation and orchestration of AI agents that integrate processes, data, and systems to automate workflows.

Enables creation and orchestration of AI agents that integrate processes, data, and systems to automate workflows.

Integrations & Connectors

Enables creation and orchestration of AI agents that integrate processes, data, and systems to automate workflows.

Enables creation and orchestration of AI agents that integrate processes, data, and systems to automate workflows.

Conversational AI & Multilingual

Enables creation and orchestration of AI agents that integrate processes, data, and systems to automate workflows.

Enables creation and orchestration of AI agents that integrate processes, data, and systems to automate workflows.

Security & Governance

Enables creation and orchestration of AI agents that integrate processes, data, and systems to automate workflows.

Enables creation and orchestration of AI agents that integrate processes, data, and systems to automate workflows.

AI AGENTS FOR BANKING USE CASES

See DRUID’s Banking

AI Agents in Action

Deploying AI Agents and intelligent automation for banking is a breeze with the DRUID solution library that features over 500 skills available in ready-made templates that cover multiple processes.

Onboarding & KYC

Automate document verification, customer information updates, and data collection across channels — reducing onboarding time by up to 60% while ensuring compliance with AML/KYC regulations.

Loan & Credit Applications

Guides applicants, automates eligibility checks, and accelerates approvals with full compliance built in, reducing approval time.

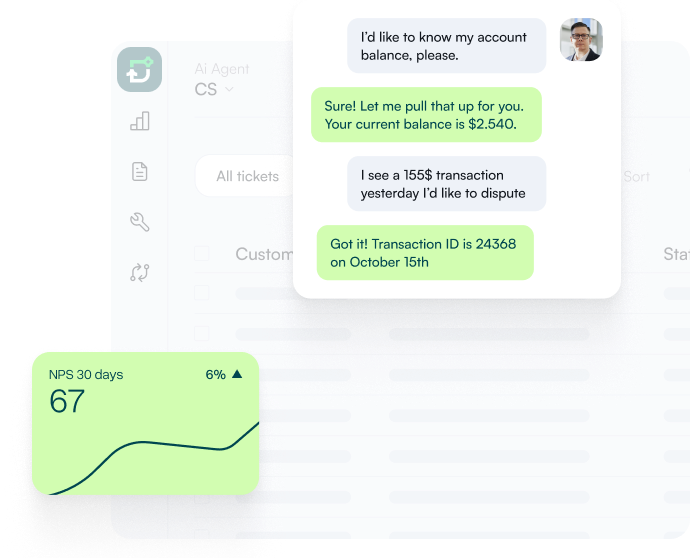

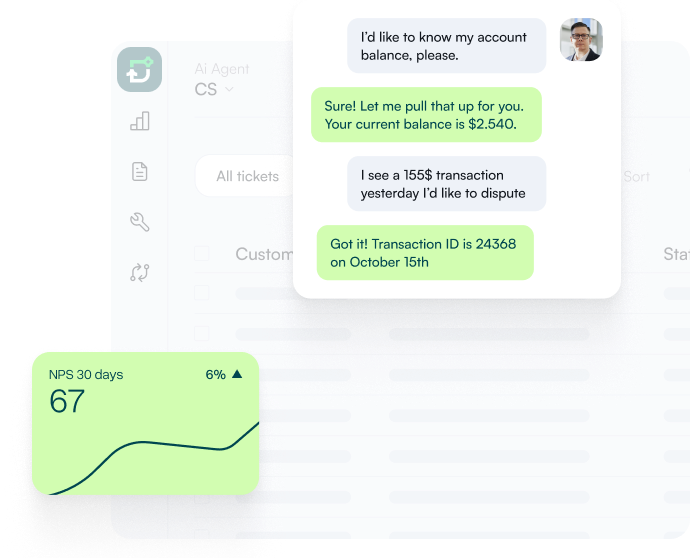

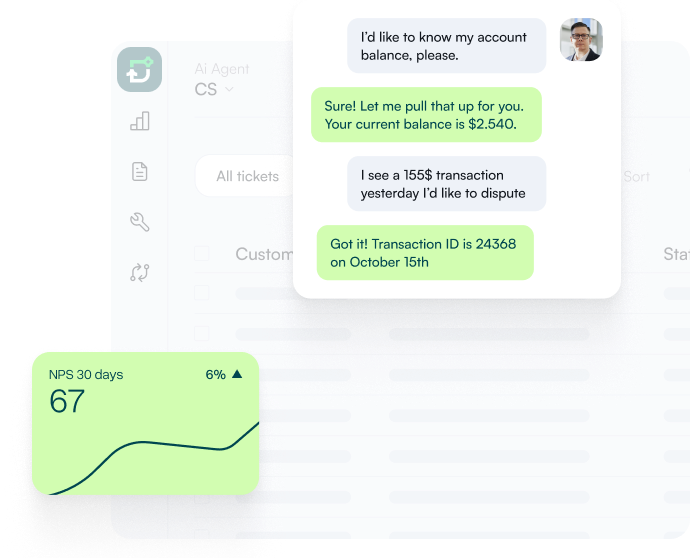

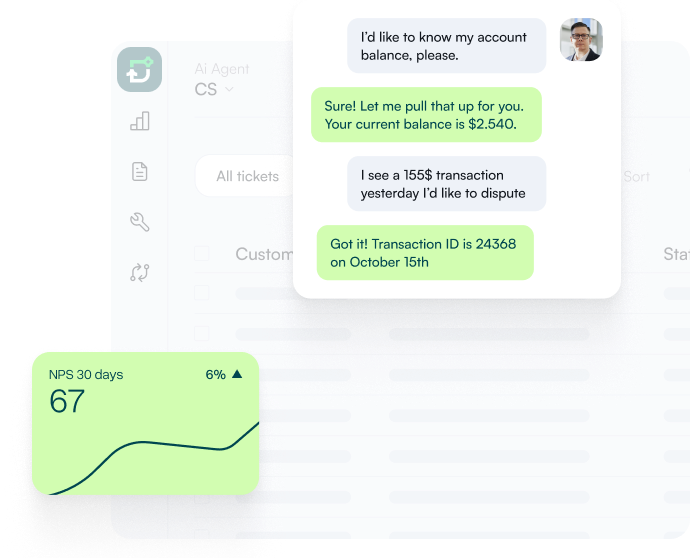

Customer Service & Contact Centers

Handle high-volume FAQs (accounts, savings, credit, payments, funds transfer) via chat, voice, and messaging-reducing call center workload and assisting human agents with real-time recommendations.

Fraud Detection & Proactive Alerts

By monitoring transactions in real time, AI Agents can proactively notify customers of suspicious activity, preventing fraud while enhancing trust and security.

Personalized Banking Services

Deliver context-aware recommendations, product offers, and financial advice at scale, tailored to each customer’s profile and history.

Internal Helpdesk & Reporting

Streamline HR and IT support for employees by automating repetitive requests (e.g., payslips, policies, system troubleshooting), freeing staff to focus on higher-value tasks.

Questions & Answers

Frequently asked questions

Get answers to the most common questions about DRUID's AI agents for banking, their implementation, and results before your demo.

How do AI agents improve customer onboarding in banking?

DRUID AI agents guide customers through account opening processes, collect required documentation, and provide real-time application status updates. This streamlines onboarding and gets customers set up faster without manual paperwork handling.

Can AI agents handle routine banking inquiries?

Yes, AI agents can answer common questions about account balances, transaction history, loan applications, and banking services. They provide instant responses 24/7, reducing wait times for customers and call volume for staff.

What banking processes can AI agents automate?

AI agents handle customer support inquiries, account information requests, loan application intake, appointment scheduling, and basic transaction assistance. They can also provide information about banking products and services.

How do AI agents help with compliance and reporting?

AI agents can monitor transactions and flag items that need attention, assist with regulatory reporting tasks, and help maintain compliance workflows. They work within your existing banking systems to support compliance processes.

-

“Robust channel engagement for partners. Strong support from Alliance and Local Channel Managers. Commitment from senior leadership.”

Sales and Business Development

IT Services

-

“What I like most about DRUID is its neutrality and flexibility. It works well across different ecosystems, with prebuilt connectors and channels that speed up integration.”

Consultant

IT Services

-

“Well versed in local language, capturing language subtleties for customer-centric models and providing stable scoring for integration with offline proprietary models.”

Manager, Project Management

Insurance

-

“Great support from the sales and tech team that facilitates implementation of an exceptional product, that has allowed us to quickly deploy Agentic AI solutions in our clients.”

Sales Director

Software

-

“My experience with DRUID has been really positive. What I like most is how easy it is to build agents and business applications, even complex flows and integrations.”

Consultant

IT Services

-

“That it is mature. That the API layer is expansive and they have deep knowledge and ability to train on every detail.”

Chief Strategy Officer

Banking

-

“It has provided us with fast access to large data storage. It is easy to use, good documentation, flexible and scalable.”

Research and Development

IT Services

GLOBAL STRATEGIC PARTNERSHIPS

Join a Community of Global Partners and Solution Builders

Top consulting firms and technology vendors partner with DRUID to craft powerful AI solutions

for enterprises of all sizes and industries. Anytime, anywhere.

CONTENT AND UPDATES

Latest updates from DRUID

AI Agents Are Already Delivering ROI. Here’s the Proof.

Discover how banks are cutting costs and boosting customer satisfaction with agentic AI. See real ROI from intelligent automation in banking.

5 Ways AI Agents Are Already Transforming Banking Support

Discover 5 real-world ways AI agents are helping banks deliver faster support, improve CX, cut costs, and boost customer engagement.

Redefining Banking: Customer-Centric AI Agent Advantage

See how a top CEE bank used DRUID AI to automate ID checks, boost data accuracy, and deliver 24/7 service while staying fully compliant.

CONNECT YOUR BUSINESS, UNLOCK ITS POTENTIAL

Ready to free your staff from administrative chaos?

See how DRUID's AI agents can automate appointment scheduling, provide 24/7 patient support with 96% accuracy, and handle administrative tasks so your staff can focus on exceptional

patient care.